sss philippines contribution|Iba pa : Clark How Much Of Your Income Is Required For SSS Contribution? Your monthly contribution is based on your compensation. The current SSS contribution . Contact Details City: Sycamore Phone: 256-249-4705 Email:

[email protected]

sss philippines contribution,Who Can Pay SSS Contribution? Why Pay Your Contribution Regularly? How To Compute Your Monthly SSS Contribution: The Basics. The New SSS . How To Check SSS Contribution Online Through My.SSS Portal. 1. Go to the new SSS website. 2. Access the SSS Member . How Much Of Your Income Is Required For SSS Contribution? Your monthly contribution is based on your compensation. The current SSS contribution . How To Pay SSS Contribution in 3 Steps. 1. Get a Payment Reference Number (PRN) 2. Present or provide your PRN when paying a contribution. 3. Wait for your payment confirmation. What Is . Government Benefits. How to Check SSS Contributions Online: 3 Easy Ways. Rouselle Isla. Last updated February 01, 2023. In the past, tracking one’s monthly SSS contributions meant visiting an SSS .

Republic of the Philippines Social Security System. uSSSap Tayo Portal May katanungan ba kayo? Gamitin ang uSSSap Tayo Portal! Online Registration and Coverage No SS Number yet? Get it here! .Republic of the Philippines Social Security SystemThe SSS commits to provide all members with adequate social security benefits on time, especially in times of contingencies such as sickness, maternity, disability, old age, death, and even unemployment. There are two (2) types of coverage under the regular SSS Program: Compulsory and Voluntary. Compulsory Coverage: Employer (Business or .

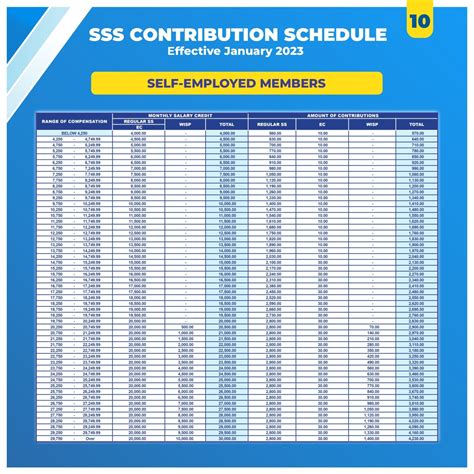

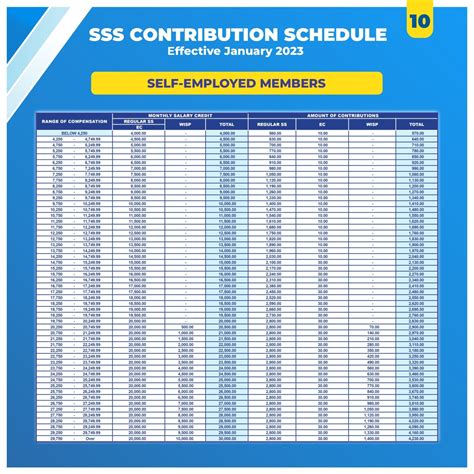

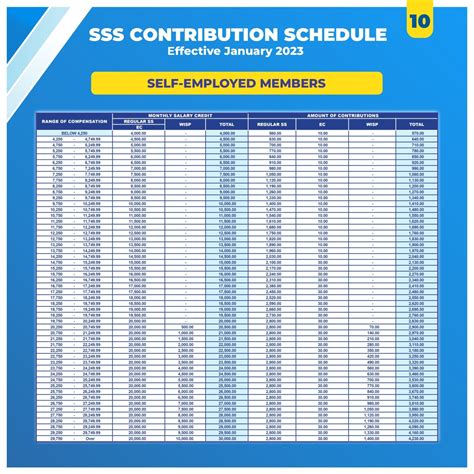

Based on the circular, the SSS enacted Republic Act No. 11199, otherwise known as the Social Security Act of 2018, which includes a provision that states there will be changes to the contribution effective year 2021, as follows: Social Security (SS) contribution rate increases to 13%. Minimum Monthly Salary Credit (MSC) increases to P3,000.

sss philippines contribution Iba pa2018, which includes a provision that increases the SS contribution rate to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to P30,000.00 effective year 2023, the new schedule of contributions of ER and EE is hereby issued and shall be effective for the applicable month of January 2023 as per Social SecurityTo the Employer. An employer who does not report temporary or provisional employees is violating the SS law. The employer is liable to the employees and must: pay the benefits of those who die, become disabled , get sick or reach retirement age; pay all unpaid contributions plus a penalty of three percent per month; and. As of July 2021, SSS has more than 2.9 million pensioners, wherein 1,791,273 are retirement pensioners, 1,059,119 are death pensioners, and 74,418 are disability pensioners. For accurate information and updates on SSS programs and benefits, visit and follow SSS on Facebook and YouTube at “Philippine Social Security System,” .

Section 10. SSS Registration Number as a Condition for Employment ... 62 Section 11. Admissibility of Microfilmed SSS Records and Other Archived Media... 63 Section 12. SSS Coverage as a Requirement in the Issuance orsss philippines contributionOpen to all: Overseas Filipino workers and voluntary members who are at least 60 years old upon the date of submission of retirement claim application. Employee-members who are at least 60 to 64 years old and separated from employment. Excluded are underground or surface mineworkers and racehorse jockeys. Members who are at least 65 years old .2018, which includes a provision that increases the SS contribution rate to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to P30,000.00 effective year 2023, the new schedule of contributions of voluntary member and non- working spouse is hereby issued, and shall be effective for the applicable month of SSS Online Registration: Creating an Online Account for your SSS. Step 1: Go to the SSS website’s online registration page. Step 2: Click the “Not Registered” option on the lower-right corner. Step 3: On .SSS President and CEO Michael G. Regino said that under the said app, individual members (self-employed, voluntary, non-working spouse, and land-based Overseas Filipino Worker) may pay their contributions using their GCash, PayMaya, or Bank of the Philippine Islands (BPI) account, or debit/credit card. Apart from this, individual .The SSS Chief further elaborated that WISP Plus serves as an additional layer of social security protection apart from the retirement benefits that they will receive from the regular SSS program until their retirement. “For as low as P500 per payment, SSS members can already contribute to the WISP Plus and pay their contribution anytime. Based on the SSS contribution table below, your employer pays ₱997.50 while you (the employee) pay ₱472.50 for a total monthly contribution of ₱1,470.00. The total contribution includes a small payment to the Employee Compensation Program, which is ₱10.00 for an MSC of up to ₱14,500, and ₱30 for an MSC of ₱15,000 or more.Republic of the Philippines Social Security SystemIba paFrom 2019 until October 2022, SSS has already disbursed P3.78 billion in unemployment benefits to more than 287,000 members. Likewise, the annual maternity benefit disbursement rose by 78% from P7.07 billion in 2018 to P12.54 billion in 2022. The SSS Chief also said that the previous contribution increases boosted benefit disbursements . For example, if you’re an Employee of a company in the Philippines with gross monthly salary of P15,000.00, the relevant row is the compensation range “P14,750 – P15,249.99” in the “SSS Contribution Table for Employees and Employers”.The Social Security System (SSS) recorded 1.34 million Overseas Filipino Worker (OFW) members as of June 2021, higher by over 800,000 from the same period in 2020. . For instance, a member with a monthly income of P8,000 will pay the entire SSS contribution of P1,040. Meanwhile, an OFW with a monthly income of P25,000 should pay an SSS .

sss philippines contribution|Iba pa

PH0 · sss philippines contribution table 2023

PH1 · sss philippines contribution table 2022

PH2 · sss philippines contribution 2023

PH3 · philippine sss contribution table 2021

PH4 · philippine sss contribution 2022

PH5 · new sss contribution table 2020

PH6 · maximum sss contribution in philippines

PH7 · check sss contribution online

PH8 · Iba pa